How to Prevent Significant Violations in Market Conduct Reviews

Market conduct has become a key insurance regulatory focus over the last decade. Insurance regulators work diligently to ensure the welfare of consumers. And insurance companies work diligently to stay in compliance — but mistakes happen. And they can be costly to both the insurance company’s brand and their bottom line. Let’s look at two recent examples of violations that occurred in New York state.

Lessons Learned the Hard Way

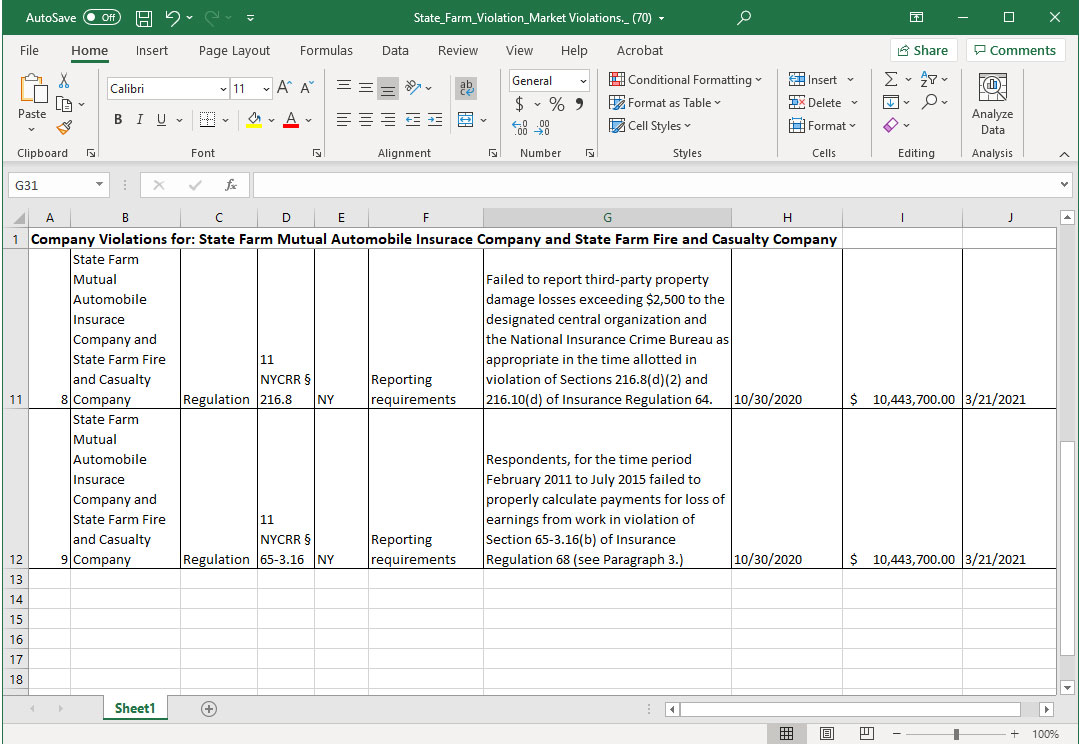

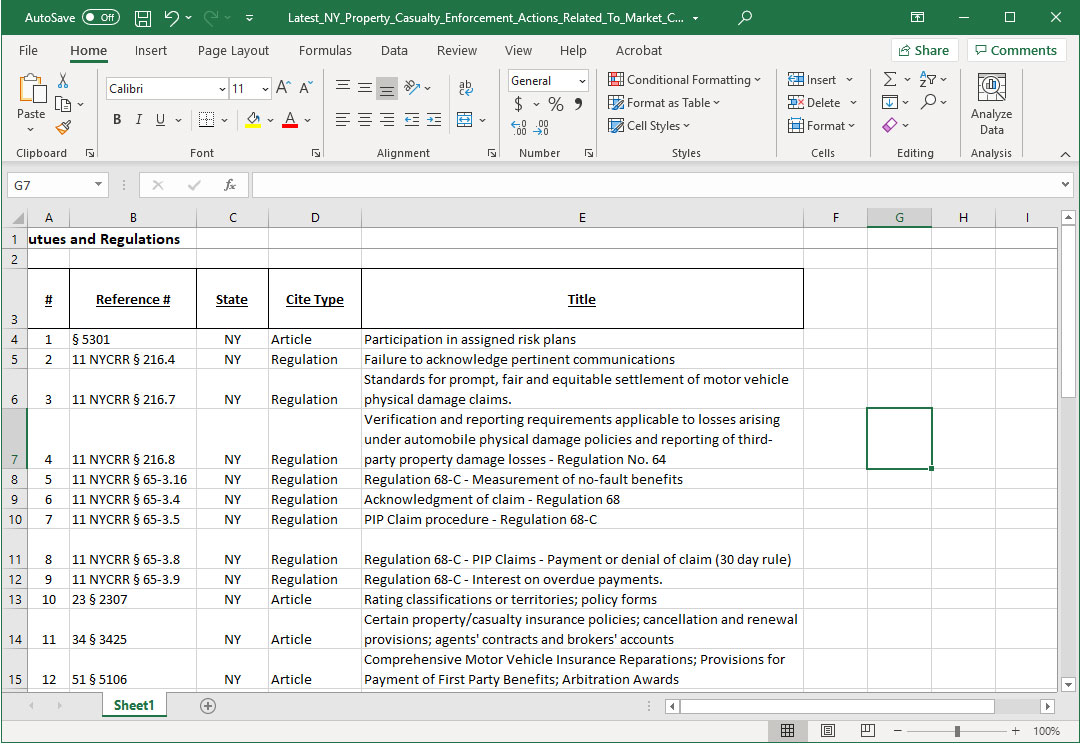

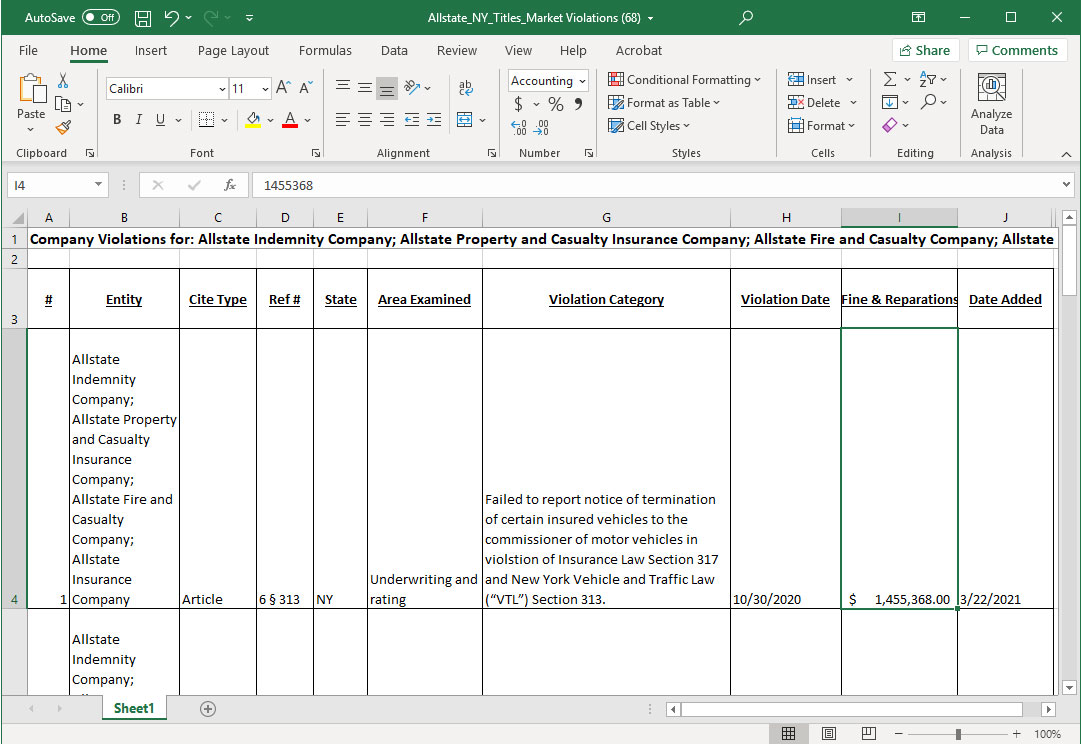

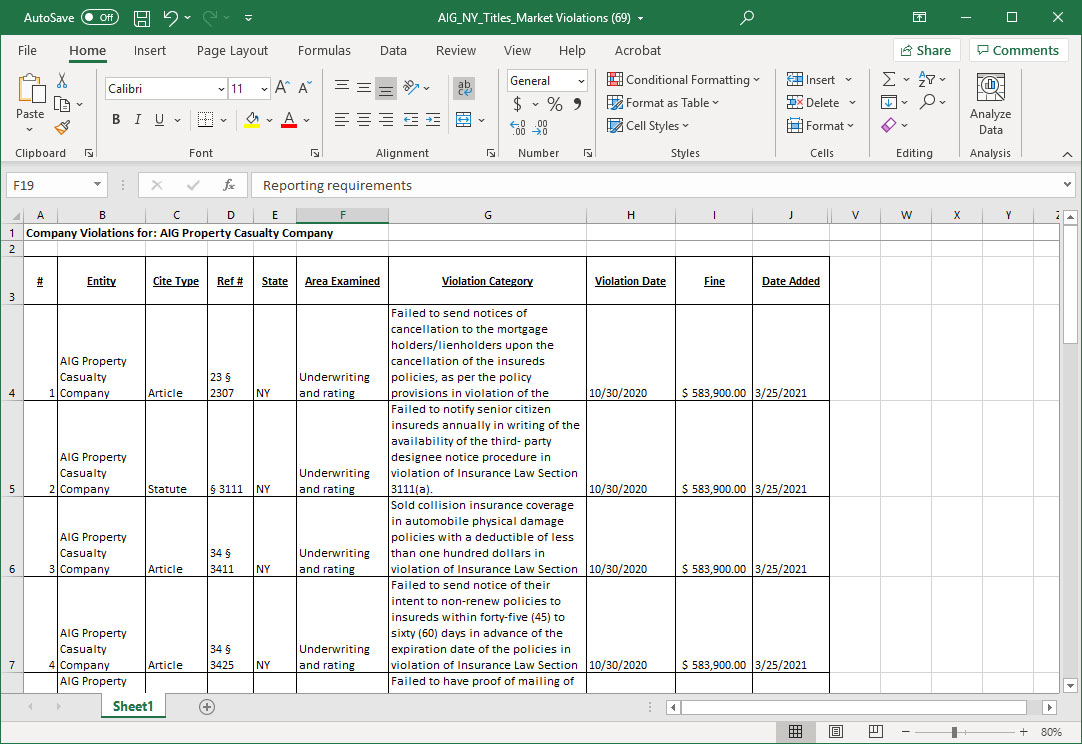

For all the work compliance departments do to keep everything in order, market conduct examiners are constantly finding and issuing violations. When reviewing four recent market conduct investigations in NY, violations were issued to Allstate, AIG, Tri-state, and State Farm for failure to:

- Pay or deny no-fault claims in a timely manner

- Pay statutory interest on overdue no-fault payments

- Correctly calculate no-fault payments for loss of earnings from work

- Send the explanation of benefits from to the injured party at least every six months

- Notify senior citizen insureds annually in writing of the availability of the third-party designee notice procedure

The resulting fines and reparation? One word: significant. Allstate and State Farm paid $784,168 and $9,799,000, respectively, in restitution to adversely affected consumers due to systemic non-compliance of no-fault claims handling. The total fines and restitution paid by the four insurers examined totaled $12,700,268.

How to Protect Your Company

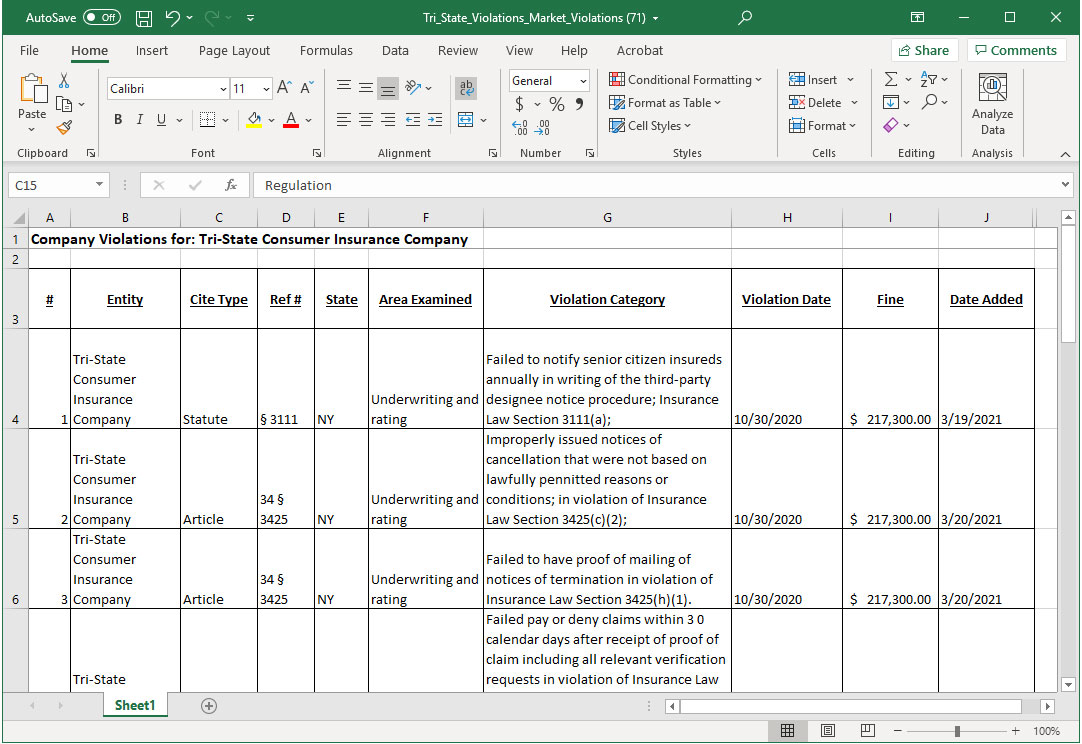

Having in-depth knowledge of what state market conduct examiners focus on as well as details on previous violations can help you stay a step ahead. Web-based software like Market Conduct Auditor® lets you do just that. The image below shows the statutes and regulations that were violated in the above-mentioned investigations, including charts of the specific violations for each of the four insurers that are taken from the Market Conduct Auditor database.

Images of violations downloaded from the Market Conduct Auditor® database.

DOWNLOAD THE EXAMPLES HERE

If you’d like to learn more about how to use recent violations to plan a comprehensive audit process for your company and lines of business, we’d love to help. Contact Lou Penn & Associates today for a demo of this software.