Protect Your Insurance Company from Significant Market Conduct Fines

Think fines from market conduct exams can’t add up? Think again. In a recent investigation of National Union Fire Insurance, the New York Department of Financial Services uncovered numerous violations that cost the company almost half a million dollars. Learn what was found and how to use this insight to protect your company.

National Union Fire Insurance Company’s Recent Violations

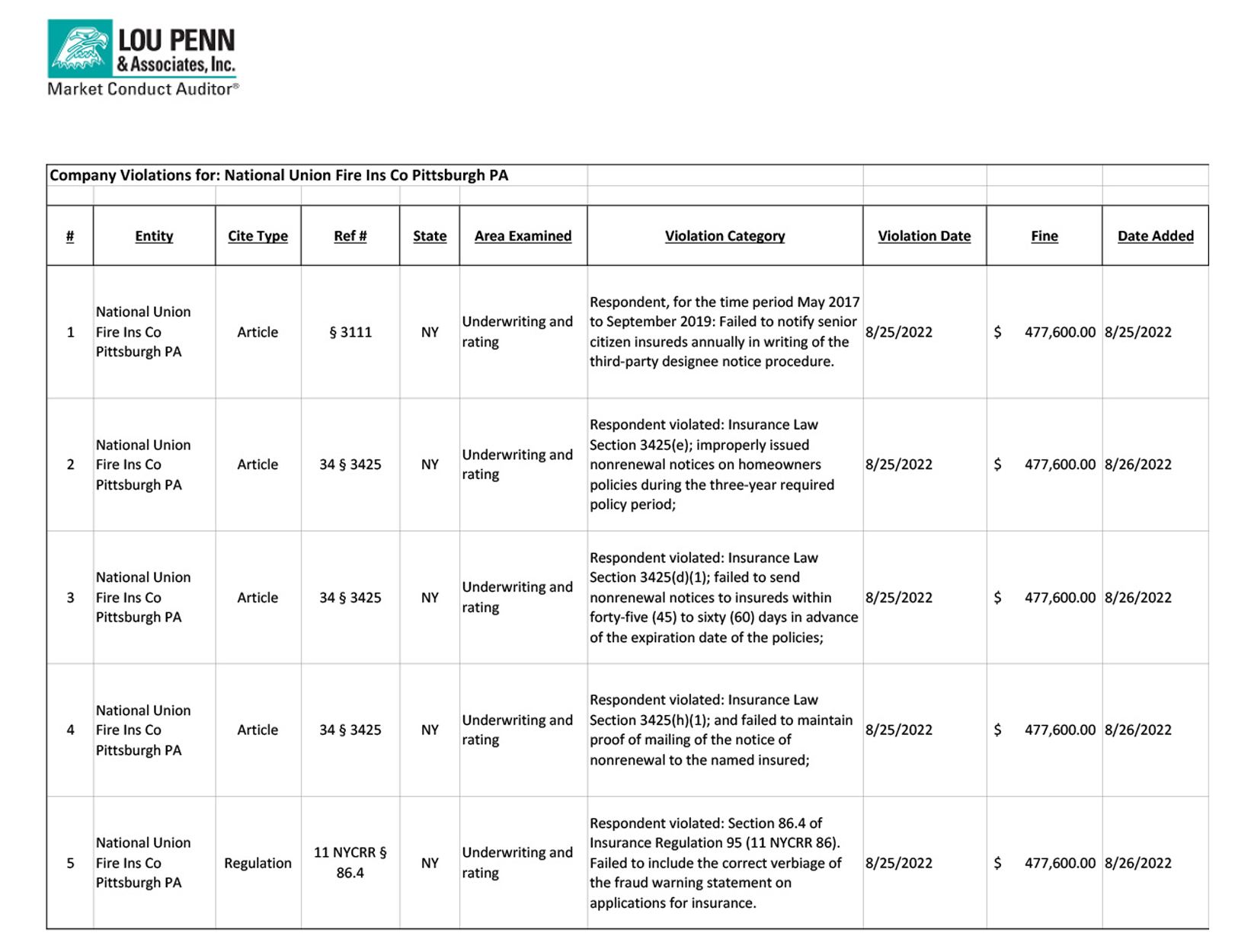

When evaluating the business practices of National Union Fire Insurance from May 2017 to September 2019, the New York Department of Financial Services identified the following violations:

- Failed to notify senior citizen insureds annually in writing of the third-party designee notice procedure.

- Improperly issued non-renewal notices on homeowners’ policies during the three-year required policy period.

- Failed to send non-renewal notices to insureds within forty-five (45) to sixty (60) days in advance of the expiration date of the policies.

- Failed to maintain proof of mailing of the notice of nonrenewal to the named insured.

The findings were released in August 2022 and came with a fine of $477,600.

Insider Knowledge Protects Your Company

Knowing the outcome of the National Union Fire Insurance investigation may have your team double-checking your third-party designee notice and non-renewal notice practices. The image below shows the statutes and regulations that were violated in the National Union Fire Insurance investigation from the Market Conduct Auditor® database.

Enhance Existing Compliance Efforts

When it comes to market conduct exams, your best defense is a strong offense. Investing in software like Market Conduct Auditor® lets you easily see the types of violations exams uncovered as well as the associated fines. Your compliance team can use this information to ensure you’re doing your due diligence in those areas.

Even the most diligent compliance departments could use a leg-up. Using recent violations like this to plan a comprehensive audit process for your company helps you prioritize where to focus your efforts. Contact Lou Penn & Associates and schedule a demo of Market Conduct Auditor®.