New York Auto Insurance Companies

Subject to $4M in Tier Rating Violations

For almost a decade, automobile insurance companies have used a tier system to determine premium rates. Before the tier system, most insurance companies had a standard rate that was applied to all drivers, with a “surcharge” applied to those drivers who were deemed high-risk. The new tired system, which gained popularity in the early 2010s, removed surcharges and instead uses a set of risk ratings based on a variety of calculations.

Occupation and educational attainment are two of more than one dozen commonly used factors for determining the price of auto insurance in most states, but the use of these factors has become a source of debate. And in New York, it has become the center of new regulation enforcement by the state Department of Insurance (DOI).

New York DOI Amends Regulation for Tiered Rating

Following a multi-year investigation, the New York DOI amended 11 NYCRR 154, or Insurance Regulation 150, citing that auto insurers failed to show a necessary relationship between an insured’s risk of loss and their attained education level or occupation status. The filing reads:

During this investigation, the superintendent learned that some, but not all, insurers in the state use an individual’s education level attained and/or occupational status in establishing initial tier placement. The insurers’ consideration of these factors has resulted in cases where classes of insureds have been placed in less favorably rated tiers, which may lead to higher premiums, without adequate substantiation that an individual’s level of education attained and/or occupational status relates to his or her driving ability or habits such that the insurer would suffer a greater risk of loss.

The insurers failed to provide sufficient support for the existence of the necessary relationship for the use of occupational status or any convincing evidence to support the necessary relationship for the use of an insured’s level of education attained, whether alone or in combination with occupational status. As a result, the insurers failed to establish that their use of education and/or occupation in establishing initial tier placement was not unfairly discriminatory.

Next Steps for NY Auto Insurers

Compliance departments for New York auto insurers must take the following steps:

- Regulation 150 generally prohibits the use of attained education level and/or occupational status as a factor in initial tier placement, as well as requiring insurers that had previously used those factors in initial tier placement to amend their multi-tier rating programs and tier movement rules to the satisfaction of the superintendent for policies going forward.

- For policy renewals, Regulation 150 requires that insurers remedy any continuing impact of their prior use of education level attained and/or occupational status in initial tier placement on an insured’s premium rate.

Millions in Fines Uncovered in 2021

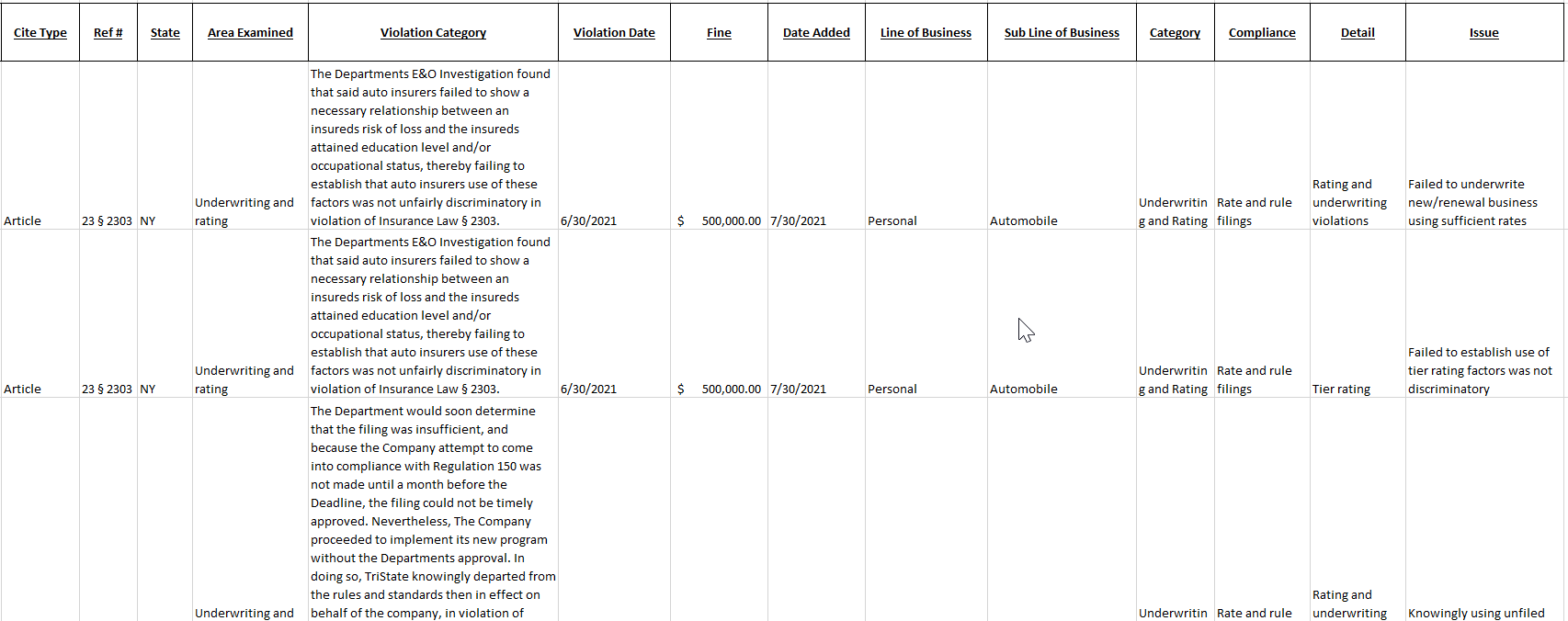

Although the amendment went into effect in 2018, auto insurers in New York are still being fined. This June alone, the New York DOI fined auto insurers $4 million for tier rating and underwriting violations. This snippet from Market Conduct Auditor® shows the violations:

Knowingly using unfiled rates and failure to establish the use of tier rating factors that are not discriminatory are key issues.

Compliance teams for auto insurers doing business in New York should review tier rating practices and ensure you are not in violation.

If you need assistance performing reviews, or want to see a demo of Market Conduct Auditor® and how it can help you see what compliance issues other NY auto insurers are in violation of, give Lou Penn & Associates a call at (866) 458-4333.