Regulatory Exam in Your Future?

So, you’re being audited. Those words can quicken the pulse of even an experienced compliance officer, but there are many ways you can be prepared. State Departments of Insurance have long had the statutory power to examine insurance companies. There are many areas that regulatory examiners can focus on, from underwriting practices to sales and marketing tactics. When you multiply that across several industries and lines of business, the compliance requirements you must keep track of grows exponentially. And, if you sell policies into different states, it becomes even harder to keep track of changing laws in different jurisdictions.

Whether you have an exam or audit in your future, or you just like the confidence that comes with preparation, these three practical tips can help you minimize your exposure ahead of time.

1. Understand the exam reason.

Each state has an insurance department in charge of regulating insurance companies in their state and ensuring compliance with laws required to maintain compliance with their requirements. It’s important to understand why the exam was called on your company to provide insight into what issues they might be focusing on. Aim to learn the scope of the exam and if it’s routine or targeted. Typically, you will only be going through an exam on a set cycle unless there are other matters at play.

2. Perform a mock exam.

Some companies hire experienced former Department of Insurance employees or similar consultants to perform mock exams and help identify any potential areas of non-complaint activity ahead of time. Mock exams are beneficial because it gives your team an outside perspective on your activities and identifies pitfalls you might not be seeing.

3. Use market conduct software.

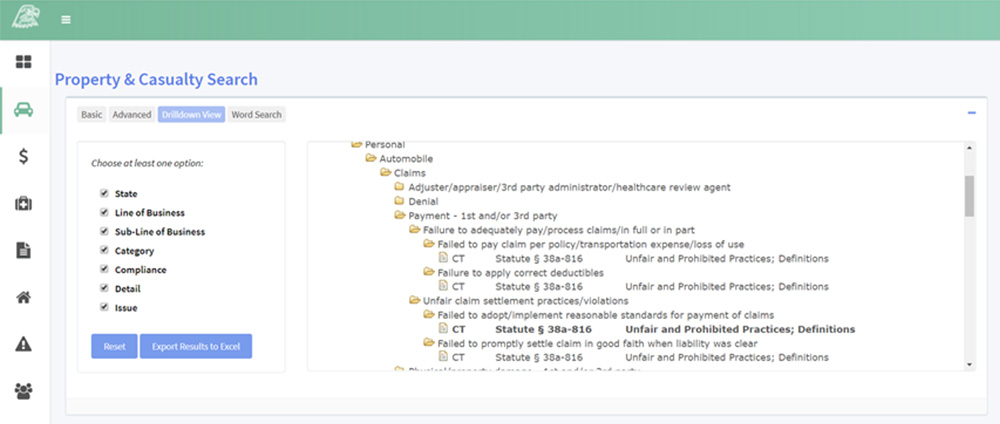

There is software on the market, like Market Conduct Auditor, that can enhance the effectiveness of your company’s existing compliance efforts. Then combine it with state of the art research for up-to-the-minute compliance requirements for each state by industry, line of business, category, issue, and more. This provides a cost-effective and turnkey compliance program that helps give you peace of mind. If you’re vetting market conduct software, be sure to look for drill down search methodology. It saves valuable time by seeing all the statutes and regulations that are the subject of market conduct criticism in the state (or states) you are evaluating. It’s even more helpful if that material can be printed, emailed, or exported into a spreadsheet.

To learn more about ensuring you’re ready for whatever your state’s Department of Insurance brings your way, call Lou Penn and Associates at 1-866-458-4333 or sign up for a demo of our popular Market Conduct Auditor software.